Unlocking Africa’s blue horizon: Marine innovation & opportunity across the continent

Africa’s coastal nations are redefining marine tourism and innovation. This report – anchored by a bullet-point breakdown of key countries – previews the African Boating Conference 2025 and the continent’s rise as the next global marine frontier

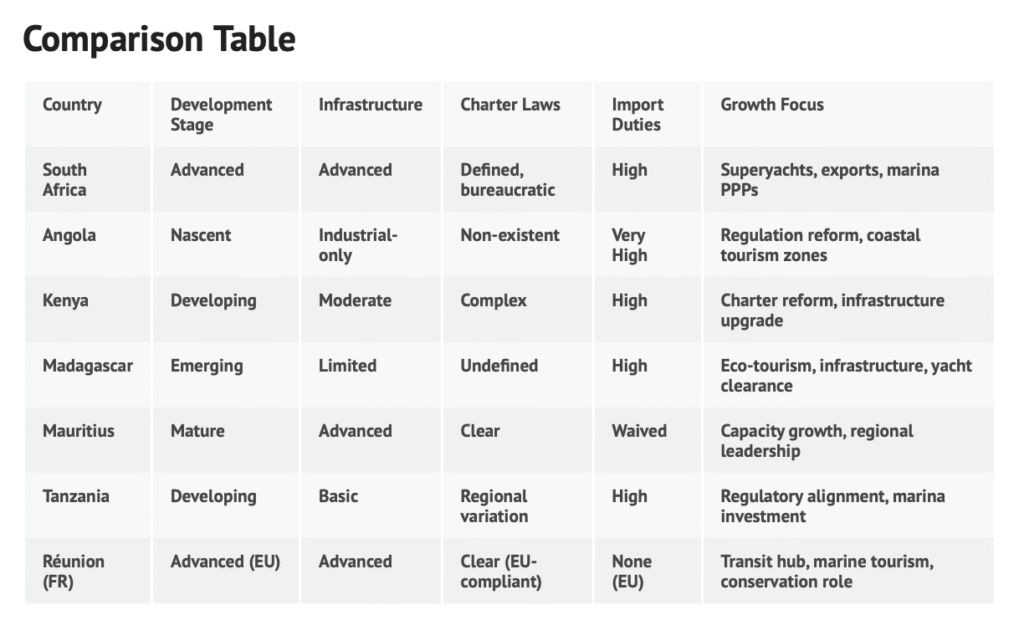

Across the Southern and Western Indian Ocean, Africa’s coastal nations are charting a bold new course for marine tourism, infrastructure development, and blue economy innovation. From South Africa’s advanced boatbuilding and growing superyacht services to Mauritius’ mature marina ecosystem and Madagascar’s untapped eco-yachting potential, the region offers a spectrum of investment-ready opportunities. With countries like Kenya, Tanzania, Angola, and Réunion each facing unique challenges and showing distinct promise, the African marine landscape is ripe for transformation. The African Boating Conference 2025 will spotlight these opportunities and the people driving them – offering stakeholders the insights and connections needed to unlock the continent’s vast blue potential. With Africa emerging as the next marine sector growth region it is critical businesses understand the markets and position themselves to take advantage of these growth opportunities. This conference is a landmark event designed to demystify Africa and unveil the continent’s untapped potential in the superyacht and recreational marine sectors. This is not just another industry gathering; it’s your front-row seat to in-depth insights on opportunities, infrastructure needs, cruising routes, supply chains, manufacturing, tourism development, training and education, and government regulations across Africa’s diverse maritime landscape.

South Africa

Current Situation:

- Africa’s most developed boating industry with strong boatbuilding (e.g., Robertson & Caine), advanced marinas (V&A Waterfront, Durban Marina), and export-led manufacturing (90% of catamarans exported).

- Charter activity is growing; superyacht visits to Cape Town are increasing due to Red Sea instability.

- Strong regulatory oversight (SAMSA), but bureaucratic inefficiencies and high import duties persist.

Focus for Growth:

- Expansion of marina infrastructure

- Attracting superyachts through better berthing, provisioning, and streamlined regulations.

- Public-private partnerships in marina development.

- Policy reform to reduce tariffs and align jurisdiction across departments.

Angola

Current Situation:

- Marine infrastructure is industrial and oil-sector-focused, not leisure-driven.

- Recreational boating is rare and limited to elite users.

- Import duties are very high, and there is no real charter framework.

Focus for Growth:

- Reforming regulation to allow leisure marine activities.

- Attracting investment in Luanda, Lobito, and Benguela through tourism-oriented marine planning.

- Laying groundwork for future eco- or tourism-led marine development.

Kenya

Current Situation:

- Active marine tourism centred on Mombasa, Lamu, and Diani.

- Existing dhow tours, dive and sport fishing charters, with Tamarind Marina a key facility.

- Infrastructure (haul-out, servicing) is underdeveloped.

- Complex charter laws and high import duties hinder private boating and foreign investment.

Focus for Growth:

- Streamlining charter regulations and vessel clearance.

- Enhancing haul-out and service infrastructure.

- Promoting marine tourism investment with coastal communities as beneficiaries.

Madagascar

Current Situation:

- An emerging eco-yachting frontier with pristine anchorages (e.g., Nosy Be, Île Sainte-Marie).

- Very limited infrastructure (marinas, fuel, haul-out), with high duties and no formal charter law.

- Increasing visibility due to boutique tourism and international interest (e.g., AD Ports MoU for infrastructure upgrades).

Focus for Growth:

- Positioning as a premium eco-conscious superyacht destination.

- Improving yacht clearance and safety procedures.

- Attracting marina investment and building basic support infrastructure.

- Aligning tourism with conservation and local community benefit.

Réunion (France)

Current Situation:

- French territory with EU-grade marine infrastructure, clear regulations, and strong environmental standards. Small leisure boating market but important for provisioning and maintenance.

Focus for Growth:

- Serve as a regional support and transit hub, expand marine tourism offers, and contribute marine science and conservation leadership

Mauritius

Current Situation:

- The region’s most mature marine leisure sector.

- Advanced marinas (Grand Baie, La Balise), modern haul-out and service facilities.

- Clear and supportive regulatory framework; import duties waived for charter vessels.

- Strong integration between marine leisure and luxury tourism.

Focus for Growth:

- Continue refining service quality and superyacht readiness.

- Serve as a regional benchmark and training hub.

- Expand capacity while preserving high service standards.

Tanzania

Current Situation:

- Marine tourism focused on Zanzibar and Pemba (dhow tours, diving, fishing).

- Basic infrastructure; marina development in early stages.

- Fragmented regulation and high import duties hamper sector growth.

Focus for Growth:

- Centralizing regulatory control and defining clear charter rules.

- Developing marina and service facilities in Zanzibar and Dar es Salaam.

- Leveraging strong tourism demand for marine product expansion.

Categories

Copyright African Boating Conference 2025 | All rights reserved